(Note: the first assumption is sometimes called "short selling with full use of the proceeds to buy other stocks" or words to that effect. The only reason I see for teaching the second approach is if you want to stay consistent with Markowitz's original paper.

FWIW (and I don't want to advertise a specific firm) my account at Inter $**$tive Brokers allows me to take short positions corresponding to the first equation, and I am certainly not a big institutional investor. If you have no opinion and just want my recommendation I would say: use the first method.

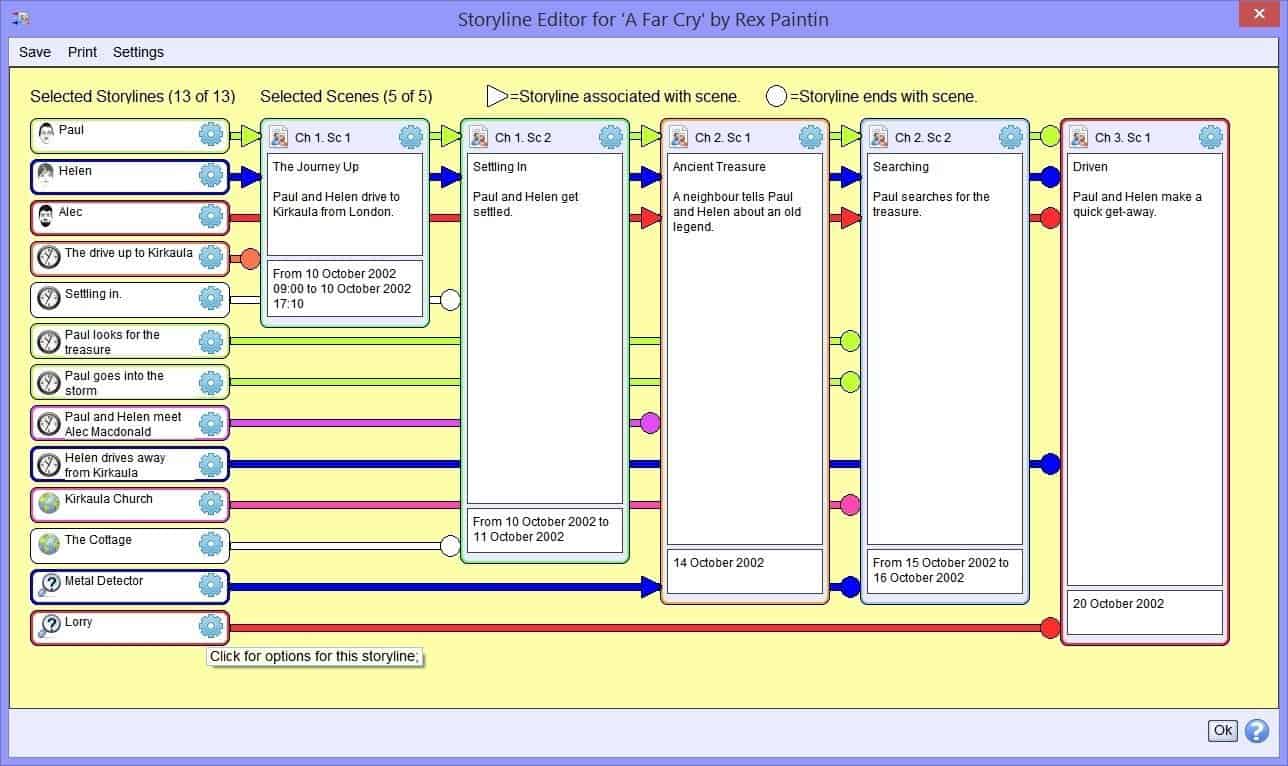

#WRITEITNOW LIMITATIONS SOFTWARE#

This software is ideal for novelists due to its arranged interface that makes excellent use of graphics and text in an instinctive outline. WriteItNow can help you share your thoughts.

Useful if you want to keep your text file as clean and well formated as possible. You want to share your story with the world and have been wondering which one is the best writing software. added: You can optionally show non printable whitespace characters paragraph breaks, tabs and redundant spaces. You are free to choose whichever assumption you think is more appropriate for your situation (depending on local regulations and your broker's policy), or even to prohibit shorting entirely by requiring all $x_i \ge 0$ (in which case taking absolute values or not does not matter anymore). Plugins are locked and will work only with a valid writemonkey donor key. The second view may be more representative of how retail investors think about shorting (if indeed they take short positions at all). C Merton for example argued that this was correct (he should know as he eventually started a hedge fund). In time I believe the first view came to dominate, not only is it mathematically simpler but it is fairly realistic of how hedge funds really operate (at least under modern U.S. Some authors modeled short positions as negative and required all weights to add up to 1 (first equation), others (including Markowitz himself) thought this was not realistic (he thought if you have 1 dollar you cannot both buy 1 dollar worth of stock and also short 1 dollar worth of stock) and required the second condition (if you have equity of 1 dollar you can buy half a dollar of stock(s) and short half a dollar of other stock(s)). In the early days of Portfolio Theory there were different views about short positions.

0 kommentar(er)

0 kommentar(er)